What is the Wage Protection System in Oman, and how does it affect you, the employee or the employer, in the private sector? I am going to tell you everything you need to understand how the system works, why it matters to your job, your business, and how it helps bring you some peace of mind.

I am Ahmed Al-Shanfari, and I have years of experience observing the impact of labor reforms on the private sector in the Gulf. I had the opportunity to witness the development of the WPS in Oman, and honestly, this is not an ordinary law. It is an instrument that may help companies to save a lot of funds, keep workers secure, and make the payroll process efficient.

Within this blog, I will take you through a step-by-step process of how the Wage Protection System in Oman makes it works and what is expected under the rule.

What is the Wage Protection System (WPS) in Oman?

Wage Protection System (WPS) in Oman is an electronic salary transfer system that was launched to regulate and supervise wage payments in the non-public sector; the Ministry of Labour (MoL) introduced this. It makes sure that the workers get their salaries on time, fully paid to them, and through the financial side of the bank and not in the form of cash or under-the-table payments.

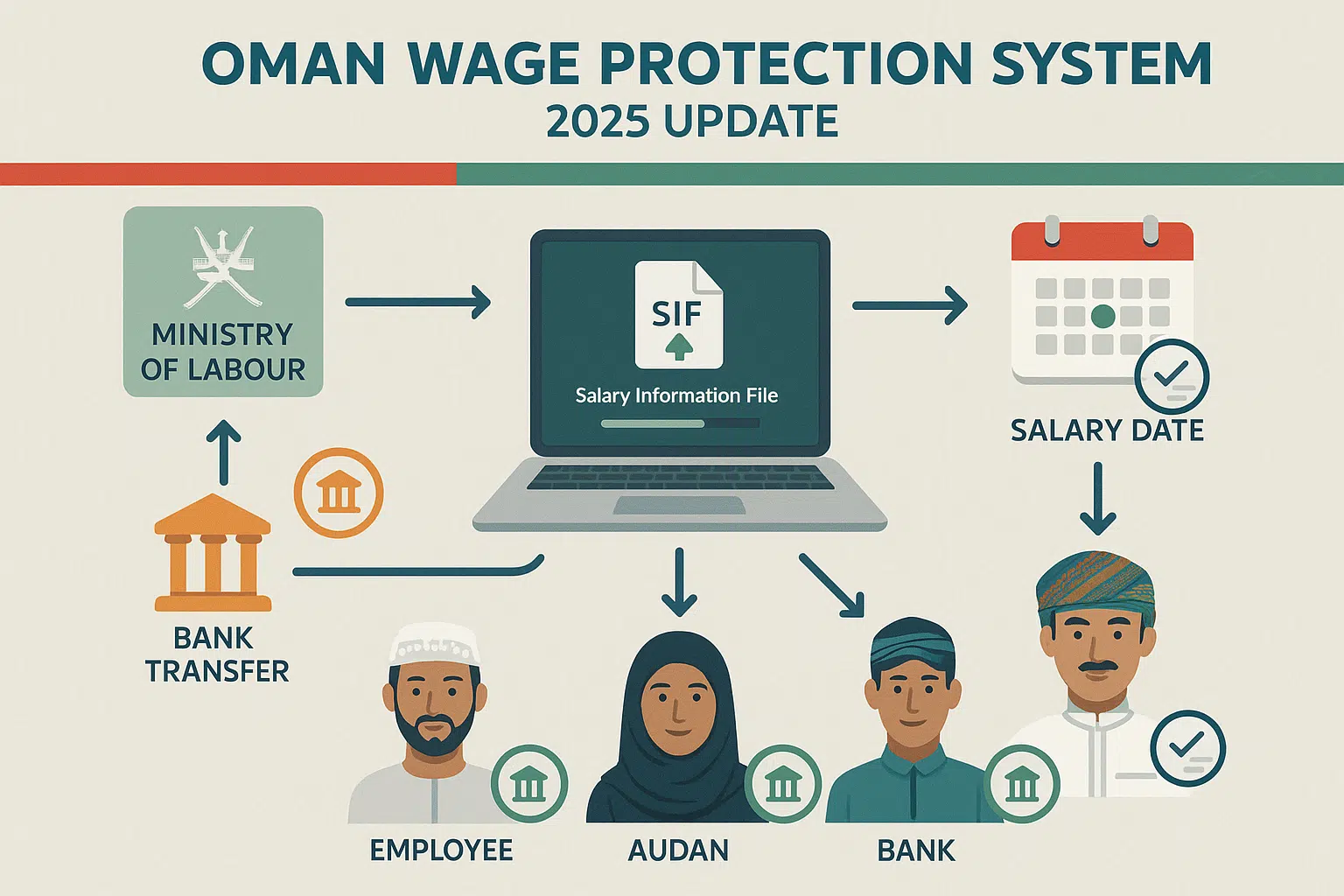

This system demands that employers load a Salary Information File (SIF) of salary information for every worker per month.

Wage Protection System (WPS) came into action in Oman to rectify a chronic issue of late, non-payment and under-reporting of wages in the private sector.

How the WPS Works

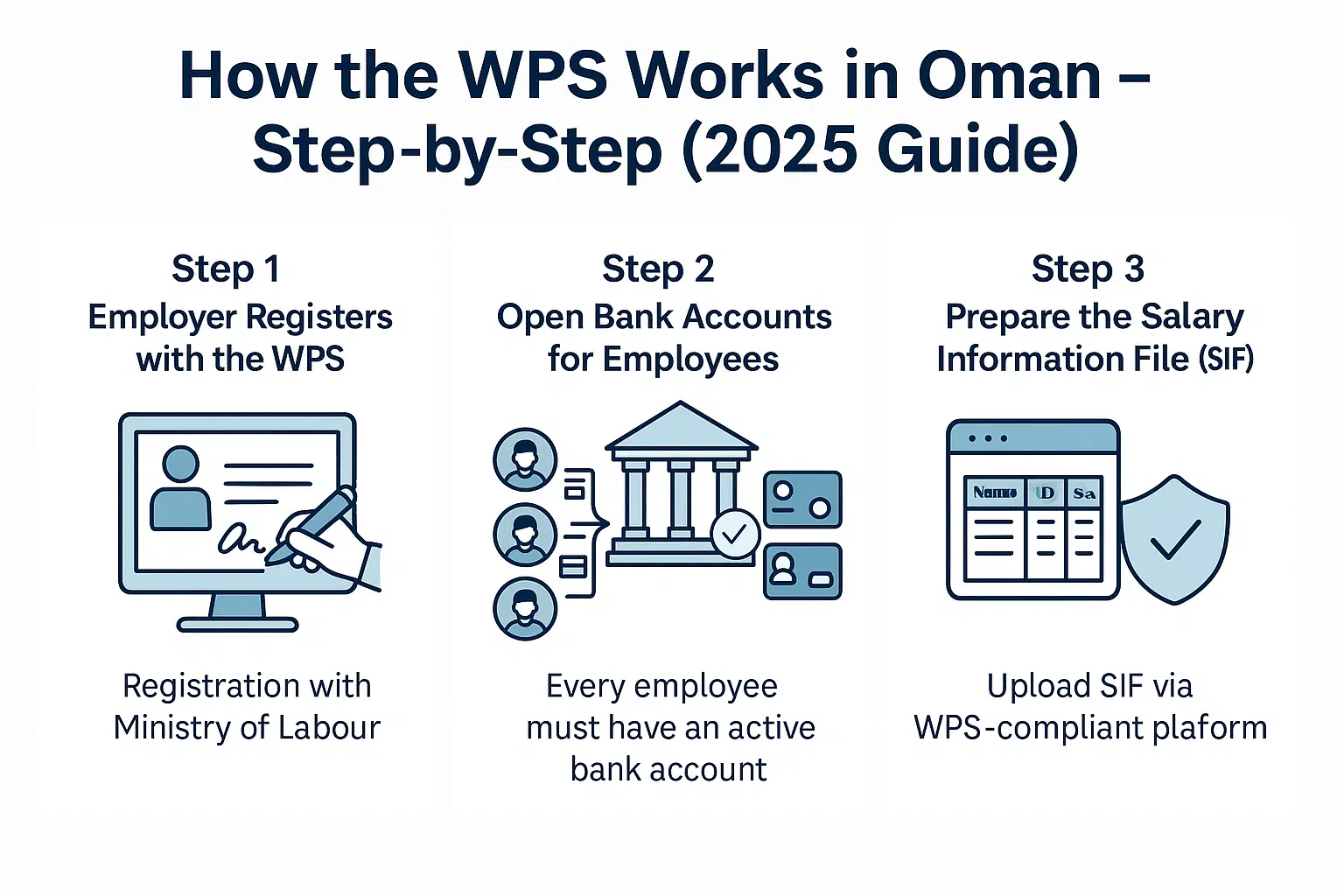

1. Employer Registers with the WPS

The start is registration-based. Employers must enroll their company in the WPS portal of the Ministry of Labour. This registration links your Commercial Registration (CR) and your salary database to the monitoring system of the MoL.

- You can complete this registration through the Ministry’s online portal.

This step allows the Ministry to take note of your company; hence, before the end of the day, they can be watching your salary disbursements.

2. Open Bank Accounts for Employees

All your employees, regardless of whether they are Omani or expatriate, must have legitimate, valid bank accounts in Oman.

- It will be your responsibility to make certain that each worker has a usable account.

- The payments should be made directly into the account of each employee; payments made in cash are not acceptable as per the provisions of WPS.

3. Prepare the Salary Information File (SIF)

It should be thought of as an online payroll report where the payments of each employee will be listed.

These are some of the things that the SIF must contain:

- Employee’s full name and Civil Number

- Employee’s bank account number

- Basic salary and allowances

- Deductions (if any)

- Net salary paid

- Salary month and payment date

The file is supposed to be in a format based on the MoL and bank requirements. Any small formatting error may lead to a rejected file.

4. Submit SIF to the Bank or Payroll Provider

When the SIF is completed, you will submit it in the bank portal of your firm or via an authorized payroll service provider organization.

- The bank collects the data, authenticates it, and plans the settlements of salaries.

- The file must be submitted in time before the deadline stipulated for making payment.

- The goal of most companies is to clear salaries before the first day of the month just to be safe.

It is at this stage that wages of your employees are paid out officially and at the same time monitored by the government.

5. Salary Disbursement & MoL Notification

The instant salaries are transferred

- Each employee receives their salary directly into their personal bank account.

- The bank will pass a report to the Ministry of Labour on the salaries they have paid successfully.

Automatic monitoring that you do not have to make any manual reports. However, it also entails that no one can conceal any fault or time lag.

Read Also: 10-Year Saudi Visa for US Citizens: Apply Online Now

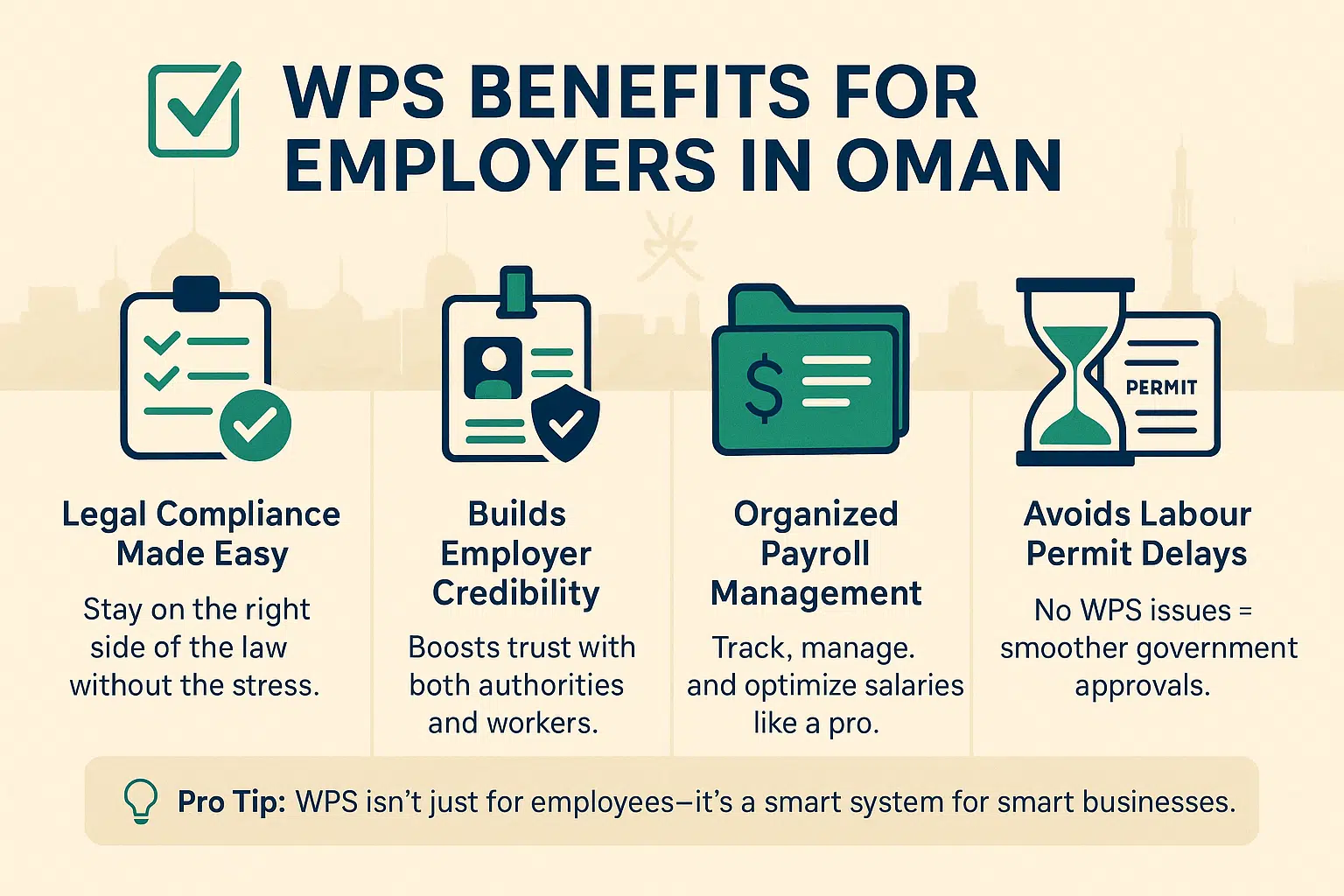

Benefits of the Wage Protection System (WPS)

1. Legal Compliance Made Easy

With the help of the WPS, it is easy to remain aligned with the labour laws. You will not be involved in any of the following as long as you pay salaries on time and input correct data:

- Fines

- Work permit suspensions

- Legal disputes with employees

It is an online security blanket that keeps your business where you want it to be regarding the law.

2. Builds Employer Credibility

Your workers will be aware that you will make payments on time, all the time, and this enhances your reputation as a patron who can be trusted.

This is all the more relevant in the highly competitive labor market.

3. Organized Payroll Management

WPS will demand a standardised salary procedure, and this automatically enhances your internal accounting:

- Cleaner records

- Easier audits

- Quicker reconciliation

- Fewer salary-related disputes

It’s like having a payroll assistant running 24/7.

4. Avoids Labour Permit Delays

When using WPS, your company remains on good terms with the Ministry of Labour. That means:

- Faster processing of new visas

- No delays on renewals

- Fewer government inspections

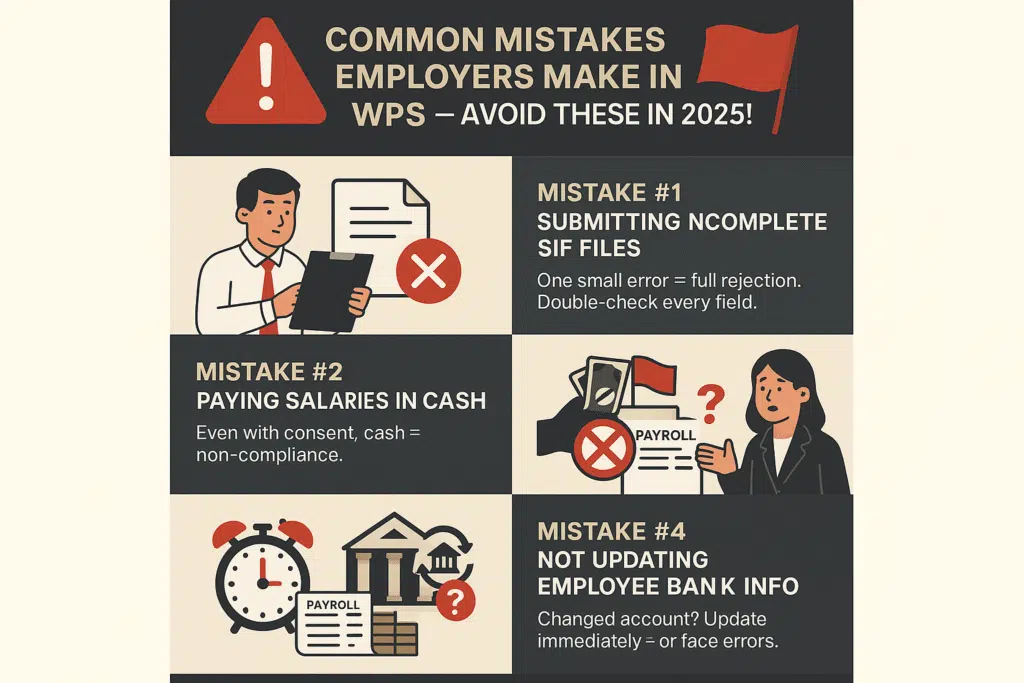

Common Mistakes Employers Make

There are a lot of companies that end up in deep waters due to minor matters. Here are the errors that are most likely to be made, and that you ought to avoid:

Submitting Incomplete SIF Files

One lost digit and your whole file will be rejected. Always outdo your format.

Paying Salaries in Cash

Under the WPS, money is not counted, including when the employee consents to it. No.

Delayed Transfers

Deliberate and unintentional payment of salaries may lead to MoL action. Set up reminders or make payroll automatic

Not Updating Employee Bank Info

When your employee changes his/her bank account, update the records later.

Quick FAQs

1. Is WPS mandatory in Oman?

Yes, and it is compulsory for all non-governmental employers in Oman who have at least one employee.

2. When should salaries be paid under WPS?

Transfers of Salaries have to be made within 3 days of the close of a salary period.

3. Can I pay salaries in cash?

No. Every salary should be sent electronically through WPS-approved banks.

4. What happens if I don’t comply with WPS?

You may be fined, suspended from the issuance of a labour permit, or worse still, be banned from business.

5. Who is exempt from WPS in Oman?

It is only certain exceptions, such as those on unpaid leave, under dispute, or newly hired with less than 30 days, subject to certain cases.

Read Also: Visa on Arrival in GCC Countries (2025 Guide + Fees)

Final Words

According to the Wage Protection System in Oman is not merely a new regulation; it is a paradigm change in the management and monitoring of salaries in nearly every part of the private sector. Being a person who witnessed the effects of WPS myself, I can assure you that it not only ensures the protection of employee rights but also provides employers with a formalized compliant means of dealing with payroll.

When you are an employer, going through the WPS process step by step, you will remain on the safe legal side, avoiding breaking the law and receiving fines, and earning trust among all the working members.