Are you in search of ways to check the FAB PPC balance? You can relax, I have the specific steps and solutions in this easily digestible, straightforward guide. I am going to show you any way possible to keep checking your prepaid funds, whether you are online, on mobile through an ATM.

I am Ali Al-Mansoor, a UAE national and a long-term user of FAB PPC cards; I use them in making business payments and for personal budgeting. Believe me, I found out everything to check the balance on this card and manage it, and not get confused.

In this blog, I will guide you on the sources you can use to check the balance of your FAB PPC card.

What is the FAB PPC Card?

FAB PPC Card, also known as the First Abu Dhabi Bank Prepaid Payment Card, is a reloadable prepaid card tailored mainly to businesses and UAE individuals. This card, unlike the credit card, enables you to preload it with a certain amount of money and then spend only what is in his or her card without any debt or interest.

When companies run businesses, they normally use the FAB PPC Card to:

- Salary of the employees

- Control costs incurred by the company

- Offer travel allowances or travel allowances

- Pay securely at well-established local and international sites

How to Check PPC FAB Card Balance Online

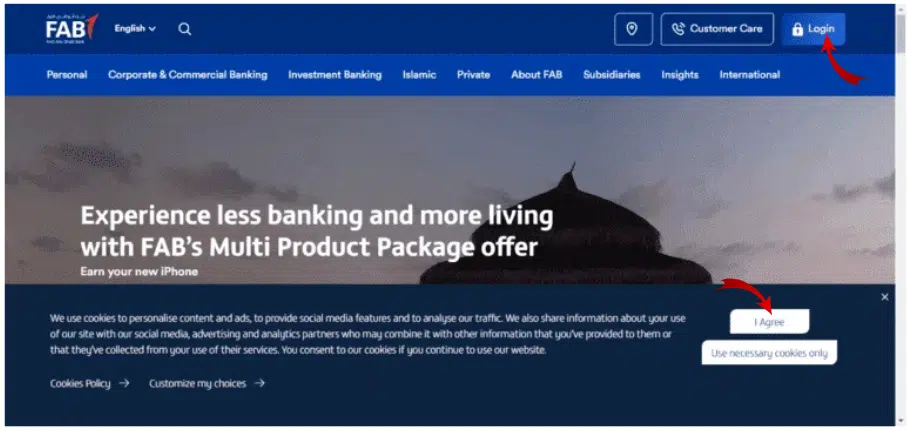

Step 1: Access the FAB Online Banking Portal

- Visit the Webpage. Visit the FAB online banking portal.

- Log in to Your Account: Enter the User ID and Password that you received at the time that you registered your card.

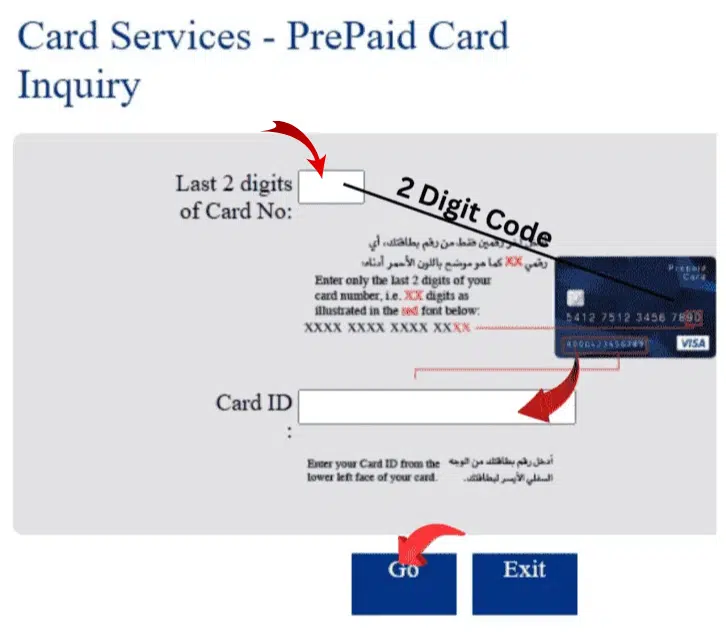

Step 2: Locate the Prepaid Card Section

On logging in, this is what I do:

- Navigate to Accounts or Card Services: Look to the dashboard, and there should be a menu titled either “Card Services”.

Step 3: View Your FAB PPC Card Balance

- Showing Amount: On the current available balance, you can see its current available balance. It is cumulatively updated in real time.

How To Get A FAB PPC Card

Step 1: Contacted FAB

- My visit to a FAB Branch: I had entered a FAB branch in Abu Dhabi and enquired to the employee about prepaid solutions for my business.

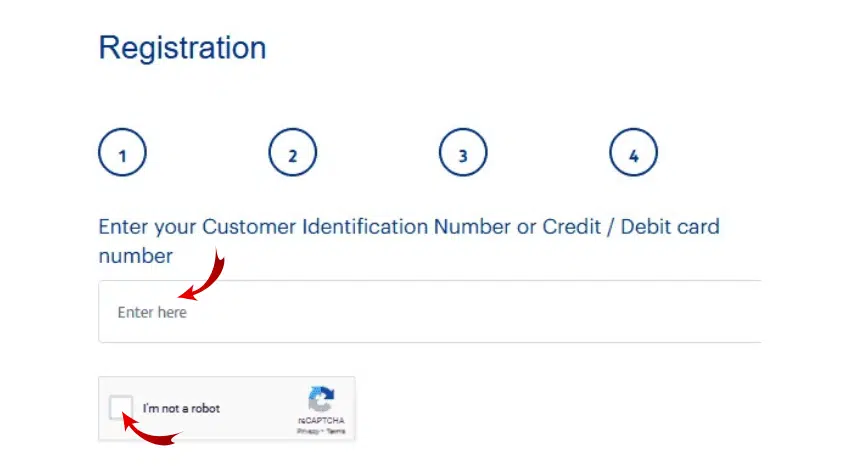

Step 2: Submitted All Required Documents

This is what I was required to give:

- Legitimate trade license (of my business)

- Passport and Emirates ID (me and the authorised signatory)

- Account number of the company’s bank.

- Employee list (in case you are delivering more than one PPC)

Step 3: Loaded the Card

Once permission had been granted, FAB issued me with my PPC card(s). After that, I accessed the FAB Business Online Portal:

- Load funds

- Establish transaction limits

- Monitor employee-wise expenditure

Read Also: Is Pornography Illegal in UAE? What Expats Must Know (2026)

Key Features

No Credit Check Needed

In my case, when I joined the FAB PPC card, I did not have to show a credit check. It is a prepaid card, so you are merely spending the amount you put on the card.

Instant Salary Disbursement

This card is a game-changer for businesses. You are able to transfer salaries and allowances to employees with PPC cards instantly.

Track Expenses in Real-Time

I adore the fact that I can trace everything that goes on in transactions. Be it when I spend myself or when a cardholder I have assigned gets it, all expenditures appear immediately in the FAB mobile application or online interface. It makes my budgeting lean and clear.

Withdraw from Any ATM

You do not have to be limited to FAB ATMs. I have made withdrawals using any ATM that uses Visa or Mastercard anywhere in the world.

International Usability

This is no local card. I have used it overseas traveling, at the shopping store, places of eateries, or for cash withdrawals. Your FAB PPC card is accepted almost everywhere as long as the merchant has Visa or Mastercard.

Card Replacement Option

Fortunately, FAB provides a replacement. All you have to do is call their customer support, and once they are satisfied as regards your identity, they will block the old card and send you a new one. Super convenient in the application of peace of mind.

Benefits of the FAB PPC Card

No Debt or Interest Worries

Since it’s prepaid, you only spend what you put in, no credit, no interest, no debt traps.

Easy Access to Funds

I will be able to withdraw money at any time, around the world, using ATMs, and make payments directly in shops, retailers, or in a traveling context.

Instant Salary Transfers for Employees

As a businessman, I take it to pay workers or independents immediately instead of going through the waiting process of the banks.

Real-Time Tracking for Better Budgeting

I can check all transactions in real time, and this is how I can trace business and personal expenditure in a transparent manner.

Quick FAQs

1. How can I know my FAB?

You can find out through FAB’s online portal, mobile app, ATM, or by calling FAB’s customer service number.

2. Does it cost to check the balance?

No fee when inquiry is done by app, online, or FAB ATM. Some charges may apply when non-FAB ATMs are used.

3. How to get in to get FAB PPC card?

Go to an AFB branch or use the website with your Emirates identification and business license.

4. Is the FAB PPC card usable abroad?

It works, and yes, all around the world where Visa or Mastercard is valid.

5. If I lose my PPC card, how will I be right?

Quickly dial the FAB support to cancel the card and get another one.

Read Also: Transfer NOL Card Balance Easily in 2026 (3 Proven Ways)

Final Words

Now you have all the tools and steps you require to easily know your FAB PPC card balance either online, through the mobile application, at an ATM, or by reaching the customer support service. I have presented my own experience as a citizen of the UAE who actively uses this card both in business and personal spending.

When you take a FAB PPC card, it is important to manage your balance so that you know in time to avoid any declined payments or any other budgeting errors.