- How Oman Gratuity Is Calculated

- Who Is Eligible for Gratuity in Oman?

- Calculate Your Oman Gratuity Instantly

- How Gratuity Is Calculated in Oman

- Gratuity Calculation Table (Resignation vs Termination)

- Gratuity Calculation Examples

- Latest Oman Labour Law Updates on Gratuity

- Documents Required to Claim Gratuity in Oman

- What to Do If Your Employer Doesn’t Pay Gratuity

- Frequently Asked Questions (FAQs)

- Final Words

Do you not know the degree of gratuity you are supposed to have in Oman? Regardless of whether you are an expat or a local employee, you will save the hassle of a lot of confusion and get what you are rightfully entitled to by knowing your end-of-service benefits.

This guide is a breakdown of how the calculation of gratuity is done, who qualifies, and the regulations in the circumstances when you resign or get sacked.

How Oman Gratuity Is Calculated

In Oman, Gratuity is a legal end-of-service benefit accorded to employees who leave their employment. In a couple of seconds, our calculator would have determined the gratuity free.

- It is open to full-time employees who have fulfilled one year of continuous service.

- The calculation of gratuity is done based on basic salary multiplied by years of service.

- The basic salary is paid to employees at the rate of 21 days per year during the first three years and 30 days per year from the fourth year onwards.

- This will depend on the final sum that you will receive when you either resign or are terminated.

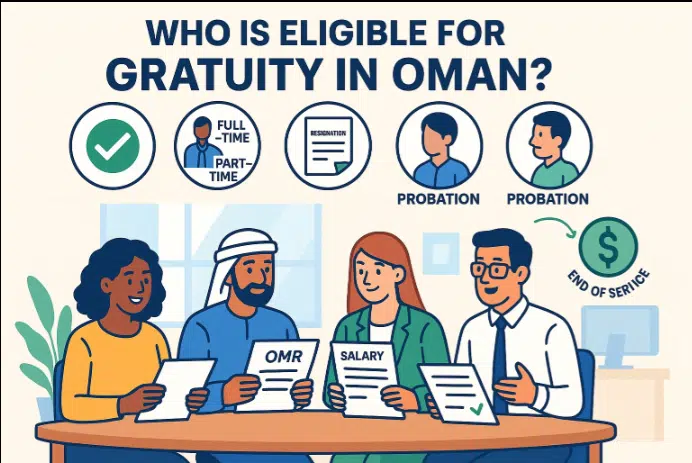

Who Is Eligible for Gratuity in Oman?

It is important to know the eligibility. Here’s a clear breakdown:

Minimum Service Required

- 1 full year of continuous service.

- Workers with a working duration of less than a year cannot qualify.

Full-Time Employees

- They must be on a conventional employment contract.

- Minimal salary must be well-established.

Part-Time Employees

- May can qualify in case their contract has end-of-service benefits.

Resignation Cases

- 1-3 years: lower rate (21 days/year)

- 3+ years: Full rate (30 days per year)

Termination Cases

- Full gratuity in case of termination without misconduct.

- Biased or no payment in instances of grave misconduct, as per the Oman Labour Law.

Probation Period

- The period of probation does not add to the gratuity.

Calculate Your Oman Gratuity Instantly

Want to know exactly how much gratuity you’re entitled to? Use our interactive Oman Gratuity Calculator here:

The calculator is simple to use:

Inputs

- Monthly Basic Salary (OMR)

- Years of Service (years & months).

Output

- Total Gratuity Amount (OMR)

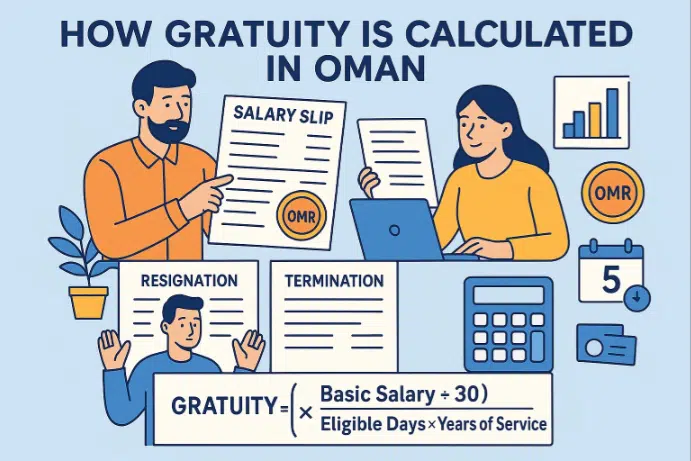

How Gratuity Is Calculated in Oman

In the Oman Labour Law, gratuity is well stipulated based on resignation, termination, and years of service.

A. Gratuity for Employees Who Resign

- First 3 Years: A basic salary of 21 days in a year.

- Over 3 Years and Under 5: 30days/year.

- More Than 5 Years: Full 30-day rate continues

- More Than 10 Years: Same 30-day rate; additional months may slightly increase the total

B. Gratuity for Employees Terminated by Employer

Full Gratuity Applies When:

- Fired without cause for misconduct.

- Contract ends normally

- Firing or loss of a company.

Deductions Apply When:

- Noble violation that the employer demonstrates.

- The breach of the Oman Labour Law.

- Fraud or breach of contract

C. Oman Gratuity Formula

The underlying formula of his calculation:

Gratuity = Basic Salary 1 30 x Eligible Days x Years of Service.

- Eligible Days: 21 days/year for the first 3 years, 30 days/year after 3 years

Gratuity Calculation Table (Resignation vs Termination)

| Years of Service | Eligibility | Days of Pay Per Year | Notes |

|---|---|---|---|

| 1–3 years | Yes | 21 days | Reduced rate for resignation |

| 3+ years | Yes | 30 days | Full rate applies |

| Termination (Non-Misconduct) | Yes | 30 days | Full benefits |

| Misconduct Cases | Partial/None | Depends | Based on Labour Law |

Gratuity Calculation Examples

Resignation After 2.5 Years

- Basic Salary: 350 OMR

- Years of Service: 2.5

- Rate: 21 days/year

- Daily salary: 350 ÷ 30 = 11.66 OMR/day

- Annual benefit: 11.66 × 21 = 244.86 OMR/year

- Total gratuity: 244.86 × 2.5 = 612.15 OMR

Employee Completed 7 Years

- Basic Salary: 350 OMR

- Rate: 30 days/year

- Daily salary: 350 ÷ 30 = 11.66 OMR/day

- Annual benefit: 11.66 × 30 = 349.8 OMR/year

- Total gratuity: 349.8 × 7 = 2,448.6 OMR

Employee Terminated After 9 Years (No Misconduct)

- Basic Salary: 350 OMR

- Rate: 30 days/year

- Daily salary: 350 ÷ 30 = 11.66 OMR/day

- Annual benefit: 11.66 × 30 = 349.8 OMR/year

- Total gratuity: 349.8 × 9 = 3,148.2 OMR

Latest Oman Labour Law Updates on Gratuity

- Revised salary scales: Basic salary has been made more precise.

- Tighter misconduct regulations: The employer has to give evidence of deductions.

- Online complaints: now, online submission of gratuity disputes is possible.

- Delayed payments audits: Employers are penalized for the hold-up of gratuity.

Read more: Find Iqama Number by Passport in Saudi Arabia

Documents Required to Claim Gratuity in Oman

- Passport copy

- Omani residence card

- Employment contract

- Salary slips (last 3 months)

- End-of-service form

- Bank account details

- Civil ID (if applicable)

What to Do If Your Employer Doesn’t Pay Gratuity

- Call HR to begin with: ask to be broken down in writing.

- Send a formal email: attach your contract and last working day, and salary slips.

- Make a complaint to the Ministry of Labour: online, in the offices, or through the hotline.

- Time: The majority of the cases take up to 28 weeks to investigate.

- Retain documentation: All emails, letters, and documents come in handy in conflicts.

Frequently Asked Questions (FAQs)

1. What is the calculation of gratuity in Oman on resignations?

The employees are given 21 days/year in the first 3 years and 30 days/year thereafter.

2. Is it a basic salary-based or full salary-based gratuity?

In Oman, gratuity is calculated based on the basic salary, and not the total salary or allowances.

3. Is gratuity given to expats in Oman?

Yes. The same gratuity benefits are accorded to expatriates as they are to the Omani nationals.

4. How much service should one have to get gratuity?

The employees need to have 1 year of consistent and ongoing employment.

5. What is the number of days of gratuity paid annually?

- 1–3 years: 21 days per year

- 3+ years: 30 days per year

Read more: Change Iqama Profession in Saudi Arabia – Full Guide

Final Words

Understanding how you can work out your gratuity in Oman is useful in ensuring you get the benefits that you are entitled to. It can help you to plan your own finances efficiently by knowing the rules, formulas, and qualifications.

Our Oman Gratuity Calculator will help you to become aware of what you are owed and see whether you are getting the right amount of it, simply by keying in the details you need. Be updated, have your documents ready, and defend your rights. You should always be rewarded for your hard work.