Have you ever considered investing in the stock market in Oman as a citizen of the UAE? People aren’t on their own, and, yes, it is a heck of a lot less intimidating than you may imagine. This guide will be very detailed to help you enter the Omani stock market smartly, including setting financial goals, finding a good broker, opening an account, and confidently making your first investment decision.

My name is Ahmed Al-Shanfari, and I am a proud citizen of Oman who jumped into the Omani stock market a few years ago. I began with no experience at all, nor did you, probably. Trial and error, and an inordinate amount of research, have allowed me to determine how to go about the Omani market and not succumb to minor pitfalls that beginning entrepreneurs often find themselves in.

In this blog, I will lay it all out there and will give you a guide on how to get your Investor ID, what sort of investments you should consider, and the basic strategies that I employ to increase my portfolio.

Steps to Invest in the Omani Stock Market

Step 1: Understand the Market Structure

You should be familiar with the market before you bet one rial. I can never emphasize the need to know the tournament very well.

MSX Indexes You Should Know

- MSX 30 Index: This is the set index that follows the top 30 listed companies in Oman.

- MSX Shariah Index Tracks-Companies that face Islamic finance guidelines.

- Sectoral Indexes Pay attention to banking, industry, services, and so on.

Types of Securities on MSX

You may invest in:

- Equity (Stocks): Shares of companies such as Bank Muscat, Omantel, and Ooredoo.

- Private credit instruments, Fixed returns Instruments, Bonds & Sukuk Debt (Shariah-compliant or conventional).

- ETFs and mutual funds are suitable when they are meant to have passive and diversified investing.

Market Days & Hours

- Open: Sunday through Thursday.

- Trading Time: 9:00 hrs – 13:00 hrs Oman Time

Market Segments

- Regular Market: Top-performing and high-compliance companies.

- Parallel Market: small and mid-sized firms with fewer needs.

- Third Market Riskier, less liquid, sometimes experimental, and start-up-type listings.

The understand these elements, the more you will be able to make your investments in line with your goals.

Step 2: Obtain an Investor Number (NIN)

This gives you a green light to invest. You cannot get through the gate without a NIN.

What’s a NIN?

The National Investor Number(NIN) is another special ID that enables you to sell or purchase stocks on the MSX. It is issued by the Muscat Clearing and Depository Company (MCD).

How to Apply for a NIN

- Visit the MCD Website: https://www.mcd.gov.om

- Download the Investor Registration Form

- Submit Required Documents:

- Passport or national ID (valid)

- Passport-sized photo

- Proof of address (utility bill or lease agreement)

- Submission Method:

- Go in person to the MCD offices

- Or via a regulated brokerage house

Your NIN will be sent to you by email or by delivery after approval. Take care of it, that is the passport to your portfolio.

Step 3: Choose a Licensed Stockbroker in Oman

Here’s the fact: you really can’t just enter the market on your own. You require a middleman, and this is where the licensed stockbrokers come into the scene.

How to Choose the Right Broker

Look for:

- The Capital Market Authority (CMA) of Oman licenses it.

- Provides English and Arabic impressions

- Mobile trading apps have mobile trading applications

- Offers analysis and research instrumentation

- Serves local and foreign customers

Top Brokers in Oman (2026)

- United Securities

- Gulf Baader Capital Markets

- Ubhar Capital

- Bank Muscat Brokerage

- Financial Services Company (FSC)

Ask questions. Their platforms are to be tested. A good brokerage will not merely be a thorn to the flesh, solely making orders and instructing, but rather someone who will teach and instruct.

Step 4: Open a Trading Account

Your trading account will now be open with your NIN with the help of your broker.

Documents Required

- Copy of your NIN

- Valid Passport or ID

- Proof of residence (utility bill, tenancy contract)

- Bank account details

Some brokerages also provide a custody account-this is a way that your stocks are safely held.

Ensure your broker allows you to access their trading platform, web, and mobile. You desire the ability to trade on the run.

Step 5: Fund Your Trading Account

It is time you got your money where your ambitions are.

Funding Options

- Omani or international accounts, Bank transfer

- Deposits need to be in Omani Rial (OMR)

- Be aware that some, not all, brokers can accept multi-currency accounts (enquire before opening)

Minimum deposits are often not required, though some brokers would like you to open with OMR 1,000 or OMR 5,000 or above.

Step 6: Start Buying Stocks

And this is the promising part: you are now able to purchase your first shares.

How to Place an Order

- Logging on to the broker’s online portal.

- Access through their mobile app

- Phone/email orders (old school but still works)

What You Can Buy

- Blue-chip stocks such as Omantel, Bank Muscat, and Ooredoo

- The government and the Bonds issued by the private firm, Sukuk

- Mutual funds and ETFs (See availability with your broker)

In case you do not know what to get into, consider dividend-paying stocks or MSX 30 Index elements to be safe.

Read Also: Investor Visa Oman: Live, Invest & Own (10‑Yr LTR)

Step 7: Research Before You Invest

Be real, blind investing is a one-way ticket to disappointment. There is a need to understand what you are purchasing and the reason.

Where to Research

- Company Reports: Reading the official site of MSX

- Analytics: utilise the reporting and analysis available through your broker

- News Platforms:

- Times of Oman

- Oman Observer

- Gulf News

- MSX Social Media: Receive news, disclosures, and industry mood

What To Search?

- Revenue trends

- Dividend history

- Management reputation

- Demand for the company’s products/services within the market

- Regulatory reforms (in particular, telecommunications and banking)

Pro tip? Sign up for broker newsletters or MSX alerts so that you know what is happening instead of digging all the time.

Step 8: Reinvest or Withdraw

After you begin receiving returns, the next big question occurs to you: cash out or continue compounding?

Reinvesting

- Use dividends to invest in growth stocks or new areas

- Purchase additional stocks of financially performing stocks

- Consider bond diversification to have a stable income

Withdrawing Profits

- Money is sent back to your bank out of your trading account

- It takes differing lengths of time to process (typically 1-3 business days)

- Some brokers take withdrawal or service costs-read the fine print

You are trying to become wealthy and not race to the bank. Long-term investment always pays off with time.

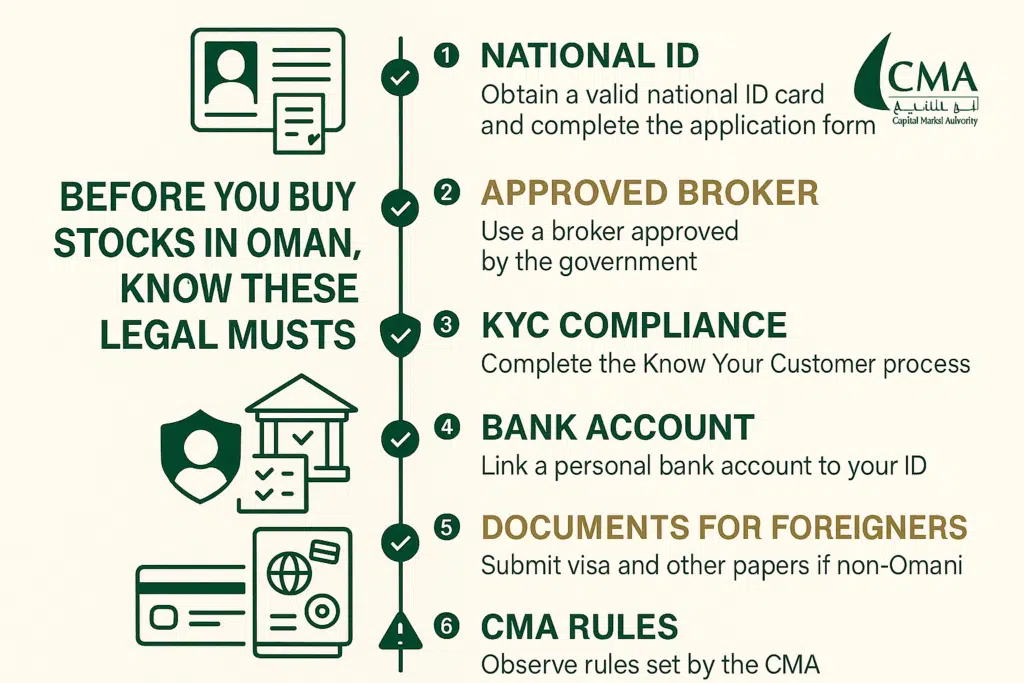

Legal Requirements for Investors in Oman

1. Get a National Investor Number (NIN)

You would need to apply for a NIN via the Muscat Clearing and Depository (MCD) via your identity, photograph, and proof of residence. Without NIN, there is no trading.

2. Use a Licensed Broker

Trading is impossible. Any order has to be placed via a brokerage firm, which has to be approved by CMA.

3. Complete KYC/AML Checks

Get prepared to identify yourself, the source of funds, and your address. That is the usual practice according to the anti-money laundering laws in Oman.

4. Fund via Your Own Bank Account

Set up an individual account that is in your name. You should not transfer funds to third parties, as the consequence is the delay of your account or locking.

5. Foreign Investors Need Extra Docs

Unless you are an Omani resident, you will most likely require international ID evidence and tax statements, depending on your broker.

6. Follow Market Rules

No dicey inside trading. No manipulation of the prices. There are no dummy accounts. There is nothing that is not under the monitoring of the Capital Market Authority (CMA) in Oman.

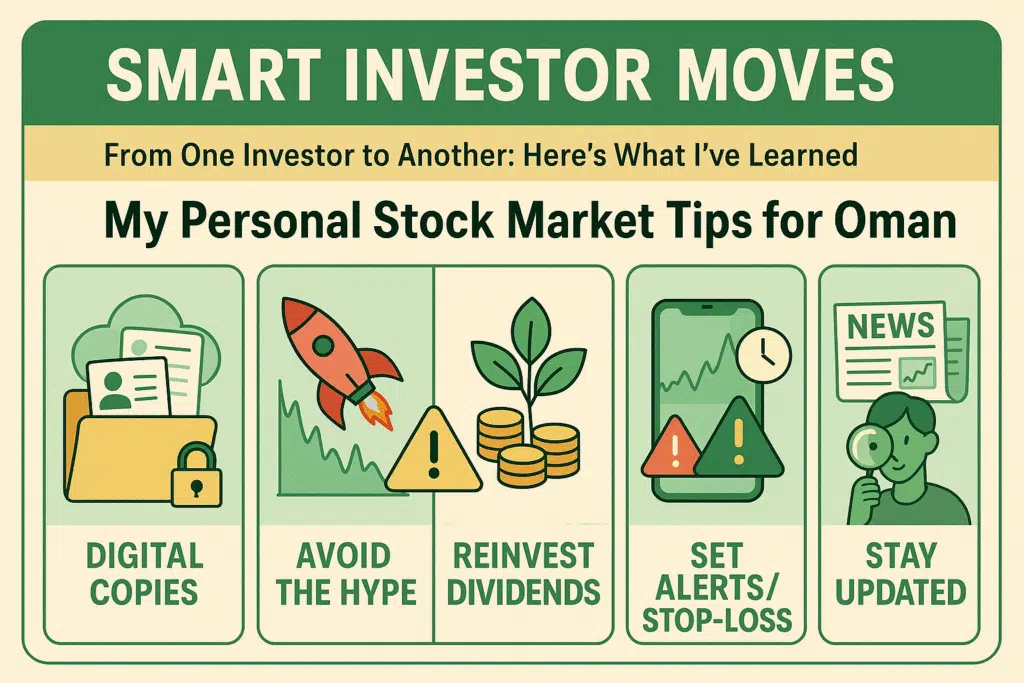

Extra Tips from Me to You

1. Keep Digital Copies Handy

Put your NIN, ID, broker details, and trading passwords in a locked computer file. There is always the desire to be able to access it in a hurry.

2. Don’t Chase the Hype

It is not all that goes up that is a golden ticket. Hold companies of good fundamentals and solid performers-slow and steady, and rich is the way of the world.

3. Reinvest Dividends

If your stocks are dividend-paying, don’t spend them. Continue to reinvest and let compound interest do its trick.

4. Set Alerts & Stop-Losses

Keep yourself ahead by using the tools of your broker. Indicate price alerts, buy limits, and stop-loss to become a pro in risk management.

5. Stay in the Loop

Markets are dynamic. Read MSX updates, talk to your broker, and scan financial news. Educated investors have it more in their favor.

Quick FAQs

Do you permit foreigners to buy stock market in Oman?

Yes, foreigners are allowed to invest by obtaining a NIN and having a licensed Omani broker.

What is a NIN, and where do I get one?

Your investor ID is called a National Investor Number (NIN). Fill in MCD with your ID, photo, and address document.

Does one have to invest a certain amount?

No formal minimum, but most brokers recommend beginning at OMR 1,000.

What is it possible to invest in on MSX?

Limited options are stocks, bonds, sukuk, ETFs, and mutual funds.

Does that mean I have to be in Oman to invest?

Nope. The right documents and a broker mean that non-residents are allowed to invest.

Read Also: Is Pornography Illegal in the UAE? What Expats Must Know (2026)

Final Words

Since you read this far, you are not merely curious; you are serious. And that is exactly how you should be to thrive in the Omani stock market. I have discussed with you how to obtain your NIN, select a broker, open your account, research, and transact your initial investment. That makes it your turn.

Be smart even when you are investing a little or a lot. Become familiar with the rules. Monitor the trends. Stay consistent.