- What Is Gratuity in Qatar?

- Who Is Eligible for Gratuity in Qatar?

- Legal Basis: Article 54

- Steps to calculate Graduity

- Gratuity for Employees Who Resign

- Qatar Gratuity Calculator (Formula Example)

- Important Notes About Gratuity in Qatar

- Gratuity Calculation for Domestic Workers

- Can Gratuity Be Deducted or Delayed?

- What If You Worked Less Than One Year?

- How Employers Should Handle Gratuity Payments

- Frequently Asked Questions for Expats

- Final Words

Would you like to know the gratuity amount you will receive upon leaving your job in Qatar? Regardless of whether you have a plan to resign or complete the term of your contract, it is imperative to be aware of your benefits at the end of the service.

Through this guide, I will illustrate how to calculate gratuity in Qatar, who is eligible, and what the latest labour law states.

What Is Gratuity in Qatar?

Gratuity, also known as End of Service Benefit (EOSB), is the amount of money you receive upon the end of your services, that is, you have rendered to your employer, provided that you have served him for at least one year continuously.

It is a token of reward and appreciation of your service and loyalty. In simple terms, your financial gratitude to the company upon the termination of your employment.

Purpose of Gratuity:

- To have money to live on when you quit a job.

- To balance long-term service.

- To be satisfied and loyal at work.

This benefit can be a significant amount in case you have worked in Qatar for several years.

Who Is Eligible for Gratuity in Qatar?

According to the Labor Law of Qatar, all employees whose service is continuous and whose service exceeds one year are entitled to gratuity, except those dismissed on disciplinary grounds as provided in Article 61.

You qualify for gratuity in case:

- Your experience working is over a year.

- You stepped down, or you have terminated your contract.

- You had not been fired on account of gross misconduct.

- You had been working on a valid contract (fixed-term or indefinite).

Even when you have swapped job roles in the same firm, your cumulative years of service in the firm qualify as gratuity unless the termination between jobs was officially done.

Legal Basis: Article 54

Article 54 of the Qatar Labour Law (Law No. 14 of 2004) spells out gratuity.

It states that:

The end-of-service gratuity will be provided to the worker who has served one or more years of continuous service by the employer. The gratuity will be in the form of the last basic salary, and the employee will get a gratuity of not less than 3 weeks’ wages per year during service.

It will imply that you will be entitled to not less than three weeks of basic salary as gratuity every year of service that you complete.

Steps to calculate Graduity

Computation of gratuity can be a bit complex to sound, but it is very easy to do in case you know the process. I will take you over them one at a time.

- Identify Your Last Basic Salary

- Calculate Years of Your Service.

- Apply the Gratuity Formula

- Calculate Your Gratuity

Step 1: Identify Your Last Basic Salary

Your gratuity is determined by your basic salary and not by allowances like housing, transportation, and bonuses.

Example:

In case you are earning a total of QAR 7,000 monthly salary, with a basic of QAR 5,000, the gratuity will be computed using QAR 000.

Step 2: Find Out Your Total Years of Service

Add up all your years and months of service with the company since the time of joining up to the last day of working.

- In case you have worked 3 and a half years, you will compute the gratuity of 3.5 years.

- The partial years are counted proportionately, even in the case of partial years.

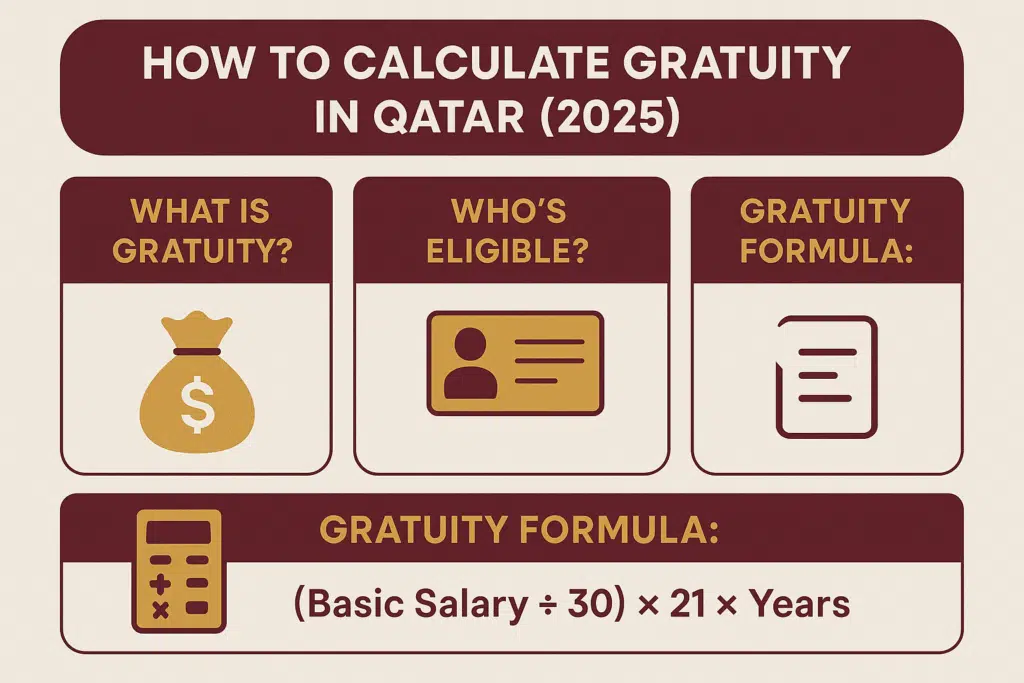

Step 3: Apply the Gratuity Formula

The form of calculation of gratuity in Qatar is three weeks of basic salary divided by the years completed.

Gratuity Formula:

Gratuity =(30 X Last Basic Monthly Salary 5) x 21 yrs of service.

Step 4: Calculate Your Gratuity

Let’s use an example:

- Basic salary: QAR 5,000

- Years of service: 5 years

(5,000÷30)×21×5=QAR17,500(5,000 ÷ 30) × 21 × 5 = QAR 17,500(5,000÷30)×21×5=QAR17,500

Total gratuity payable: QAR 17,500

This is calculated as the amount of end-of-service gratuity in Qatar in 2025, considering the new labor laws.

Gratuity for Employees Who Resign

In case you resign, you are still entitled to gratuity as long as you have served one year.

But in case your contract of employment contains certain terms in Articles 61 or 62, then you may not receive the entire benefit in case you break the terms or terminate your contract without giving the required notice.

In most cases:

- Retirement less than 1 year: You can receive the whole gratuity.

- Resignation of less than 1 year: No gratuity.

- Notice and valid reason resignation: Full gratuity.

Qatar Gratuity Calculator (Formula Example)

To simplify matters, I would typically figure out how I assist expat people in calculating their gratuity:

Formula Recap:

- Daily wage = Basic Salary ÷ 30

- 3-week wage = Daily Wage × 21

- Total = 3-Week wage x Years of Service.

You may also use our Qatar gratuity calculator online by typing:

- Basic salary

- Joining date

- Last working date

The system will automatically calculate your anticipated graciousness.

Important Notes About Gratuity in Qatar

These are the main points that you need to know before you calculate your gratuity:

- The basis of gratuity is merely on basic salary.

- It does not depend upon pension or social security benefits.

- The employers are required to pay gratuity within a period of a few days upon the last working day of the employee.

- You have the right to request your gratuity even in case of the closure of the company because it is a legal requirement.

- Salary slips and contracts should be kept at all times as evidence.

Gratuity Calculation for Domestic Workers

Domestic workers in Qatar (including housemaids, drivers, cooks, etc.) are also subject to domestically issued law No. 15 of 2017, which provides gratuity.

They are entitled to:

- Minimum salary of not less than three weeks a year after a period of one year of service.

- It is supposed to be paid within seven days of the termination of the contracts.

Thus, the law governs gratuity even when it is the case of a domestic worker or any other employee who gives them a job.

Can Gratuity Be Deducted or Delayed?

No. The employers are not in a position to either withhold or defer payment of gratuity. The deductions may, however, apply in the case of:

- The employer is entitled to the amount of money to which the employee owes.

- There are signed contracts that allow deductions that are restricted.

Otherwise, it ought to pay gratuity at once and in full.

What If You Worked Less Than One Year?

In Qatar, you are not entitled to gratuity in case you have served a period of less than one year.

This is directly written in the Labour Act that the gratuity must be paid after one year of working continuously.

Sample Gratuity Calculation

Let’s say:

- Basic salary: QAR 4,000

- Service: 7 years and 3 months

Calculation:

(4,000÷30)×21×7.25=QAR20,300(approx.)

Thus, your gratuity would be approximately QAR 20,300 after 7 years and 3 months of employment.

How Employers Should Handle Gratuity Payments

Being an employer of Expats, I would continuously remind them to always exercise the following:

- Keep effective records of the service of the employees.

- Calculate the gratuity at the end of every year internally.

- Ensure that payment is made at the expiry of the termination or resignation.

- Present facts of gratuity in final settlement letters.

Wrong documentation leads to suspicion and disagreement in the future.

Frequently Asked Questions for Expats

What is the cost of gratuity in Qatar?

This is computed on your past basic wages in Qatar. The formula is:

Basic Salary/ 30 x 21 x Years of uninterrupted service.

Who qualifies to get the gratuity in Qatar?

One year after one year of continuous service in a real contract with you, and you have not been dismissed on the grounds of misconduct.

What is the minimum gratuity in Qatar the minimum?

According to the Qatar Labour Law Article 54, the minimum gratuity is three weeks of basic salary in the course of the period that the employee has served the organisation.

Is gratuity taxable in Qatar?

Not at all. Qatar has full exemption for all employees on gratuity payments.

Can I get gratuity if I resign?

Yes, and you can also receive gratuity after at least one year of service, even at the time of resignation, provided that you observe the provisions of the notice period.

Read Also: Urgent: Esaad Card Renewal in UAE [+ Latest Changes]

Final Words

One of the most valuable things to do, whether you are a working employee or an employer in Qatar, is to learn about computing gratuity in the country. It does not indicate a sum but rather reflects on your work in service, service and the number of years worked.

As I have explained in this guide, the Qatar Labour Law (Article 54) allows that all qualified workers will receive due compensation upon termination of their employment.