Have you ever wondered, “Can I deposit money in my C3 card?” The short answer is yes, but not in the traditional way you would expect. You can’t walk into a bank and hand over cash, but C3 has built-in features like C3Pay-to-C3Pay transfers and salary advances that allow you to add money directly to your card.

In this blog, I’ll guide you step by step on how to deposit money into your C3 card, explain the methods available, and share practical tips that every expat should know.

What is a C3 Card?

A C3 card is a prepaid payroll card that is widely used in the UAE, especially by expats who may not have a traditional bank account. In place of payment of salaries in cold cash or a personal cheque into a personal bank account, the wages are deposited into their C3 card. When the pay is uploaded, the card should be used alongside a regular debit card to withdraw cash, make retail purchases, or pay online, or even send money back home via the C3Pay app.

The C3 card acts as a safety net and an easy-to-manage financial lifeline to many expats, because it allows them to access their money without having a full banking relationship.

Method 1: C3Pay to C3Pay Money Transfer

This method allows you to receive money on your C3 card from another C3 cardholder. It’s a simple in-app transfer feature that works like a mini bank-to-bank transfer.

Step 1: Open the C3Pay App

First, log in to your C3Pay app. If you haven’t already downloaded it, you can get it from the App Store or Google Play Store.

Step 2: Tap on “Send Money”

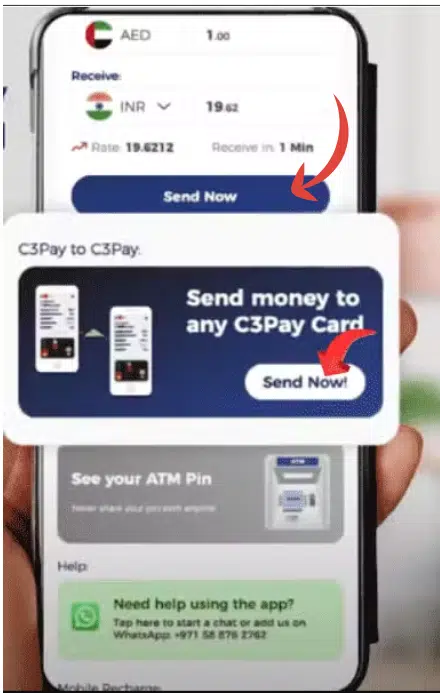

Once inside, tap the “Send Money” option. This is where you can initiate the transfer.

Step 3: Fill in the Recipient Information

In this case, you will have to give the recipient information. If you’re receiving money, the sender will enter your card details.

Step 4: Enter the Transfer Amount

Now, the sender will choose how much to transfer. This amount will go directly into your C3 card balance.

Step 5: Confirm the Transfer

The final step is confirmation. Once the sender hits confirm, the money reflects almost instantly in your C3 card balance.

Method 2: via the C3Pay App

C3Pay has a built-in feature that lets you borrow a portion of your salary in advance. It’s not a traditional loan; it’s accessing money you’ve already earned but haven’t been paid yet.

Step 1: Open the C3Pay App

Just like before, log in to your C3Pay app.

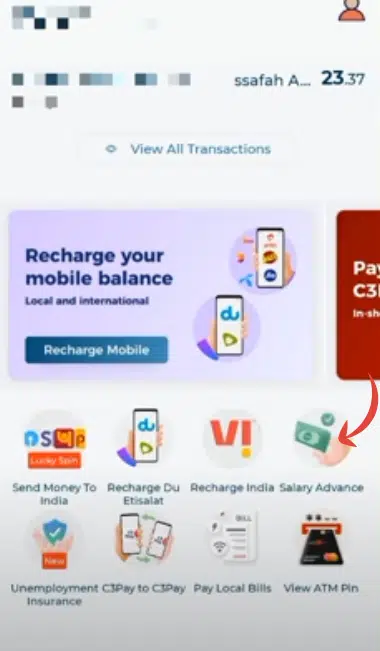

Step 2: Tap on “Take Loan” Under Salary Advance

On the home screen, you’ll see an option that says “Take Loan” or “Salary Advance”. Tap on it.

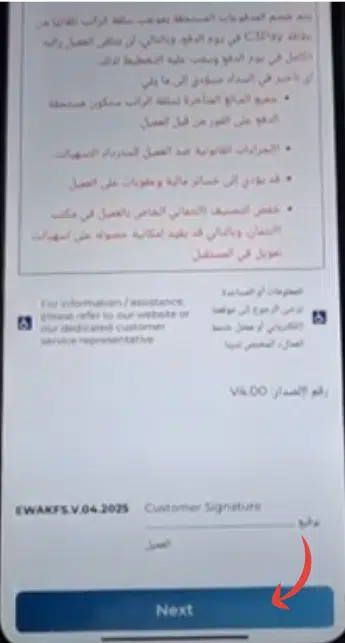

Step 3: Read the Terms

This is important. Before you borrow, read the terms and conditions carefully. Salary advance usually comes with a small fee.

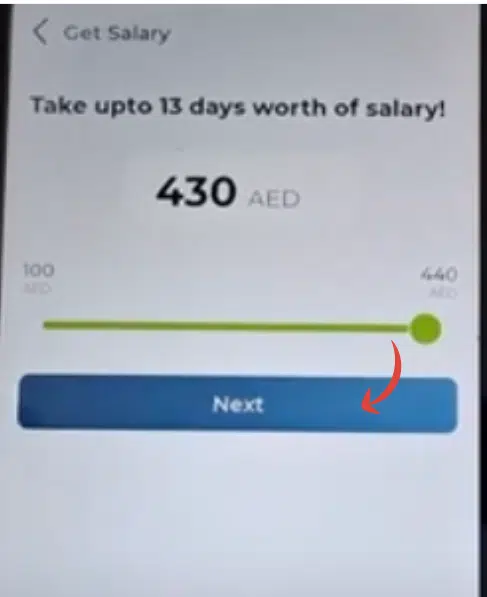

Step 4: Choose the Amount

Here, you’ll be asked how much you want to take in advance. You can only borrow a percentage of your earned salary, usually around 50% or less.

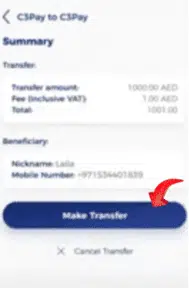

Step 5: Go over the Summary

The app will then display to you a summary: how much you are taking, the fee, and the total payday deduction.

Step 6: Tap “Get Money”

Finally, hit “Get Money” and the funds will instantly land in your C3 card.

Read Also: 4 Free Ways to Check FAB PPC Card Balance (UAE 2026)

What You Can Do With the Money in Your C3 Card

Once your salary or funds are deposited into your C3 card, you can use it in many practical ways, just like a regular debit card.

What you can do:

- Withdraw Cash: To withdraw cash, visit any ATM in the UAE to use your C3 card to obtain money at any time.

- Shop In-Store: Purchase groceries, clothes, and essentials using your C3 card at the stores.

- Online shopping: Shop using your card on online markets and food delivery services, and online service providers.

- Pay Bills: You can pay your utility bills, mobile recharge, and other bills directly using the C3Pay application.

- Send Money Home: Remit funds to your home country securely through the app’s international money transfer feature.

- Transfer to Other C3 Users: Instantly send money to friends or family who also have a C3 card.

- Access Salary Advance: Borrow a portion of your earned salary early through the C3Pay app.

Tips for Expats Using a C3 Card

- Use Salary Advance Wisely: Borrow only what you need.

- Track Transfers: Double-check transfers within the app.

- Budget Planning: Save money to pay the bills first.

- Send Money Home Wisely: Before Sending, Compare The Cost Of Remittance.

- Use it for Online Shopping: Safer than using a personal debit card.

- Avoid unnecessary costs: Go to network ATMs to save on fees.

- Updating App: Stay on top with the latest updates and security patches.

FAQs

Is it possible to load cash into my C3 card?

No, you can’t deposit cash directly. Money loads only through your employer, C3Pay transfers, or salary advances.

Can I transfer money from another bank to my C3 card?

No, only C3Pay-to-C3Pay transfers are allowed. Bank-to-C3 transfers are not supported.

How fast does money show in my C3 card?

Transfers and salary advances usually reflect instantly.

Is it possible to pay online using a C3 card?

Yes, you buy online, pay your bills, and make digital purchases as with a debit card.

Read Also: Urgent: Esaad Card Renewal in UAE 2026 [+ Latest Changes]

Final Words

To wrap it up, you now know the clear answer to the big question: you cannot directly deposit cash into your C3 card, but you absolutely can add money using the tools C3 provides. The two main options are C3Pay-to-C3Pay transfers (where another C3 user sends money to your card) and the salary advance feature.

For expats like us, these features are practical and reliable. Instead of worrying about bank accounts, paperwork, or long waiting times, your C3 card gives you instant access to your funds.