- Loan Calculation Rules in Kuwait

- How to Calculate a Loan in Kuwait

- How to Calculate a Loan in Kuwait by Using Our Calculator

- Islamic vs Conventional Loan Differences

- Real-Life Loan Calculation Examples

- Bank Comparison Table (Kuwait 2026)

- Mistakes to Avoid When Taking a Loan in Kuwait

- Frequently Asked Questions (FAQs)

- Final Words

Are you in search of computing your cost of a loan in Kuwait? You’re not alone. The majority can hardly keep up with the diversity in the profit rates, rules, and methods of repayment applied by banks. It is overwhelming to know the amount of money you have to pay monthly, the amount of overall profit, and whether you can qualify under CBK regulations.

In this guide, I will provide you with all about how the Kuwaiti loan calculations are made. Our Kuwait Loan Calculator would also help you view your monthly installment and the total cost immediately.

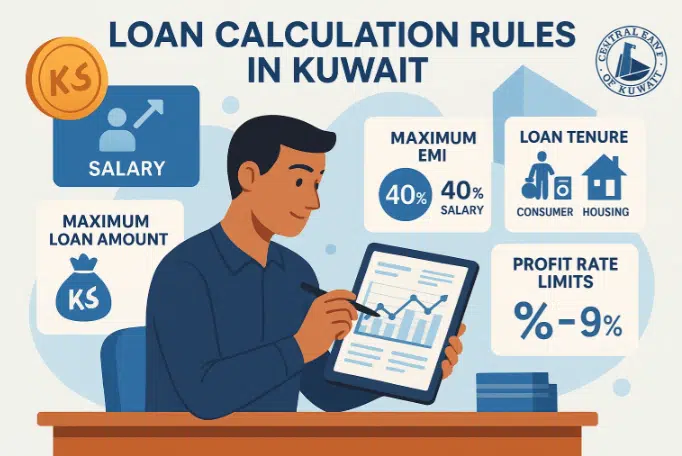

Loan Calculation Rules in Kuwait

The Central Bank of Kuwait has stringent control over the loan regulations in the country. The knowledge of these rules is to aid you in reckoning eligibility and to make you aware that a bank is giving a reasonable loan.

Central Bank of Kuwait (CBK) Guidelines

1. Maximum EMI Allowed

The maximum amount you can pay in a loan is 40 percent of your salary.

Example:

When you have an earning of 900 KWD, the highest EMI = 360 KWD.

2. Maximum Loan Tenure

- Personal loans: Maximum of 5 years (60 months)

- Consumer loans: Up to 5 years

- Housing loans: Up to 15 years

3. Maximum Loan Amount

- The Islamic banks tend to permit up to 25x your monthly salary.

- Traditional banks are differentiated based on internal policies.

4. Profit Rate Limits

The profit rates of banks should not be lower or higher than the range provided by CBK bank. Normally, between 5 and 9 percent in a year.

How to Calculate a Loan in Kuwait (Formula)

Monthly Payment = (Principal × Profit Rate × Tenure) + Principal / Tenure

- Islamic loans (Murabaha): The profit is determined in advance and accumulated.

- Standard loans: The interest can be divided into time-based on how the bank approaches it.

- CBK rule: EMI must not exceed 40% of your monthly salary.

How to Calculate a Loan in Kuwait

The easiest method of calculating any loan is as shown below, either using a calculator tool or by hand.

Step 1: Find the Bank’s Profit Rate

Each Kuwait bank has its own profit rate (typically between 5%9%). This is the initial factor that you have to work out your funds every month.

Step 2: Check Kuwait’s Salary-to-Loan Rules

- Maximum EMI = 40% of salary

- Current EMIs lower the eligibility for loans.

- Fixed and documented allowances should be provided.

Step 3: Calculate Monthly Payment

Take the common profit x tenure formula, or just take the Kuwait Loan Calculator, to get it wrong.

Step 4: Calculate Total Payable Amount

Formula:

Total Payable = Monthly Installment × Number of Months

Step 5: Compare Banks

Check:

- Profit rates

- Tenure options

- Early settlement fees

- Processing fees

This will make sure that you select the lowest loan and not the lowest EMI.

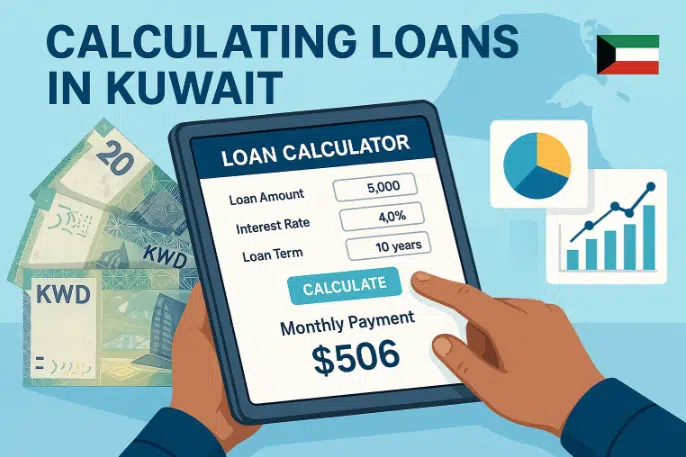

How to Calculate a Loan in Kuwait by Using Our Calculator

Our online tool allows you to calculate your loan in Kuwait in a matter of a few seconds: Calculating a loan in Kuwait in our calculator.

Follow these simple steps:

Step 1: Enter the Loan Amount

Input the sum of money you wish to borrow (e.g., 5,000 or 10,000 KWD).

Step 2: Add the Profit Rate

Enter the bank’s profit rate. This assists the calculator in giving an estimate of your installment every month.

Step 3: Select the Loan Tenure

Select the term of repayment (not more than 5 years on personal loans in Kuwait).

Step 4: Click Calculate

The tool will immediately indicate the payment that you should make monthly, the amount that you will pay, and the profit.

Step 5: Check Your Eligibility

The calculator uses the 40 percent rule in Kuwait, which is based on the amount of salary earned to determine whether you qualify and the amount borrowed.

Read Also: How to Invest in the Oman Stock Market

Islamic vs Conventional Loan Differences

| Feature | Islamic Loan (Murabaha) | Conventional Loan |

|---|---|---|

| Profit | Fixed upfront | May be fixed or reducing |

| Structure | Asset-based | Money-based |

| Monthly Installment | Fixed | May be fixed or reduced |

| Popularity in Kuwait | Extremely high | Common but less preferred |

Most Kuwaitis prefer Islamic Murabaha loans due to fixed profit and predictable monthly installments.

Real-Life Loan Calculation Examples

These examples help readers understand the concept quickly.

Example 1: Loan of 5,000 KWD

- Loan Amount: 5,000 KWD

- Profit Rate: 7%

- Tenure: 5 years (60 months)

Approx Monthly Installment: 99–110 KWD

Total Payable: Around 6,000–6,300 KWD

Total Profit: 1,000–1,300 KWD

Example 2: Loan of 10,000 KWD

- Loan Amount: 10,000 KWD

- Profit Rate: 6.5%

- Tenure: 5 years

Approx Monthly Installment: 195–210 KWD

Total Payable: 11,700–12,200 KWD

Total Profit: 1,700–2,200 KWD

Example 3: Loan Based on 900 KWD Salary

- Salary: 900 KWD

- Max EMI (40% rule): 360 KWD

- Max Loan Tenure: 5 years

Using the 360 KWD EMI, the eligible loan amount is approximately 17,000–18,500 KWD, depending on the profit rate.

Bank Comparison Table (Kuwait 2026)

| Bank | Profit Rate | Max Loan | Max Tenure | Notes |

|---|---|---|---|---|

| NBK | 6–7% | Up to 25,000 KWD | 5 years | Fast approvals |

| KFH | 5.5–6.5% | Murabaha loans | 5 years | Islamic financing |

| Boubyan Bank | 6–7% | Up to 20,000 KWD | 5 years | Islamic bank |

| Gulf Bank | 6–8% | Up to 25x salary | 5 years | Flexible terms |

| Ahli United Bank | 7–9% | Salary-based | 5 years | Higher profit rate |

This table helps users compare and choose the best bank at a glance.

Mistakes to Avoid When Taking a Loan in Kuwait

Most borrowers are guilty of the same errors that cost them more funds. Avoid the following:

1. Ignoring Total Payable Amount

A reduced EMI does not imply a reduced loan. The total profit charged should always be checked.

2. Choosing Lowest EMI Instead of Lowest Cost

Banks can extend tenure to save on EMI, but at a higher interest.

3. Not Comparing Islamic vs Conventional Loans

Fixed profit regularly causes Islamic Murahas to be lower in price. Always compare both.

4. Taking Maximum Loan Even If Not Needed

Borrow only what you need. Borrowing more places is more of a financial strain on you in the long term.

5. Not Checking Salary Transfer Requirements

Some banks offer low interest rates only when you transfer your salary.

Frequently Asked Questions (FAQs)

1. How much loan can I borrow in Kuwait?

It depends on your salary and EMI limit. According to CBK rules, the banks are not to provide EMI more than 40% of the salary. Usually, salary × 20–25 is common.

2. How much salary does one need to take a loan in Kuwait?

Expatriate salary requirements in most banks are 300-400 KWD, and for Kuwaitis, 250-300 KWD, depending on the bank.

3. What is the formula for determining the profit rate by banks in Kuwait?

Whereas conventional banks utilize flat or decreasing rates, Islamic banks utilize fixed Murabaha profit. The profit is added depending on tenure and the amount of the loan.

4. Does Islamic financing prove cheaper in Kuwait?

Usually yes. Islamic loans are fixed monthly payments and have a determinable profit.

5. How to calculate reducing balance interest?

The interest is recalculated every month by the banks on the remaining principal. The simplest way is the online Kuwait loan calculator.

Read Also: RTA Card for Uber in Dubai

Final Words

It is easy to calculate a loan in Kuwait as soon as you get to know the profit rates, rules of CBK, limits of lending out the loans, as well as the distinction between Islamic and conventional financing. It does not matter whether you are borrowing a personal loan, a Murabaha loan, or a consumer loan; the point is to compare the banks, find out the real price, and avoid the most frequent mistakes.

To be quick and correct, take any reliable online calculator, such as the Kuwait Loan Calculator, which will display all monthly payments, overall profit, and eligibility right away.